Nowadays, proprietary trading is one of the more popular trading strategies. Prop trading involves dealing with development profits and taking a percentage of their earnings. What is a prop trader, compare it with retail trader, and then discuss why it is a superior strategy in this article.

WHAT IS A PROP TRADING FIRM?

A company that offers trading solutions to clients worldwide is known as a prop trading firm. People can register with the company to become traders, and the company then provides them with liquidity. The earnings these traders produce is ultimately used by the company to make money.

Day Trade the World provides traders with the best features.

It possesses the hardware and software required for successful trading by traders from all over the world. The business also encourages the development of trading floors, which give people a great chance to make money.

There are further prop trading companies nearby. FTMO, The Funded Trader, and the 5%ers are a few of the most well-known ones. Unlike DTTWTM, these prop trading firms concentrate on FX trading and offer services using MT4 and five platforms.

DTTW™ is distinctive because it offers direct market access, has more than 50 markets, and develops its software.

How Do Forex Prop Firms Work?

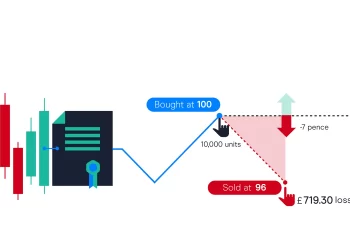

Proprietary trading firms do not employ demo accounts, unlike other trading firms that enable traders to open a demo account. Additionally, they use prop traders to trade on their behalf by providing them with a set amount of funds based on their expertise. Depending on the terms of the agreement, the corporation will deduct some amount from the trader’s profits.

The contract between the company and traders typically differs from firm to company. Some businesses, including Audacity Capital, prefer to divide profits with our traders 50/50. Other companies can offer you a profit split of 25–30% depending on various factors, including your talents.

But most prop trading companies charge a “desk fee.” This cost covers utilities, terminals, trading software, and employee wages. You must choose the ideal prop trading company to join.

It is also essential to read charts and currency pair correlation tables since they provide insight into how correlation works. A result of between -70 and 70 indicates a high association.

However, if a reading falls between -70 and 70, it suggests that currency pairs are neither very strong nor highly connected. The correlation coefficient is obtained as shown in the formula below.

Benefits of working with a prop trading firm

Utilizing a market-based prop trading firm has several advantages

To begin with, you don’t need a lot of money. Many prop companies require your skills. These businesses will fund you if you demonstrate it in a demo account. You need large initial funds to engage in retail trading.

Second, these businesses give you more money. The corporation will frequently give you more money than you already have. As an outcome, if the trades are successful, you can gain more money.

Additionally, prop trading companies like DTTW give you direct market access to pick your market maker. Finally, prop trading companies provide traders with extra mentorship and education options because their money is on the line. Ideally, they offer these solutions mostly through their top traders.

Not to mention, prop trading companies increase your chances of becoming a full-time trader. Similar to what retail trading firms do, this. A paid account is a great option for forex traders, as the TopstepFX review shows.

Trade through many platforms.

You can engage in more trading venues by trading for small prop firms. Click here to see what kinds of trading jobs and firms are available.

You are not required to discontinue trading in your personally funded trading account, and you are still free to do so using other platforms.

You are not required to work exclusively for one prop firm, and you are free to combine your flexible trading hours with other lines of work as you see fit.

The Bottom Line

Even if the benefits look huge, there are some drawbacks to every system. But if you can put up with them, your payoff will be much more than it would be if you tried trading with your resources. If you have a successful trading strategy and a strong work ethic, it may be useful for you to modify it to meet the trading strategy requirements of the appropriate fund.