Long and short positions as part of your CFD strategy

A short position in CFD trading can best be described as a way for an investor to make money off of a fall in the price of an asset. On the other hand, long positions are effectively bets that prices will rise rather than fall. Just as a short position allows an investor to make money off of a falling price by selling high and buying back low, a long position allows an investor to make money off of a rising price by buying low and selling high.

Are they always profitable?

Of course, there’s one major drawback to taking out a short position in CFD trading: if the price of an asset continues to rise instead of fall or drops more slowly than expected, the investor can end up losing money very quickly. For example, imagine that two months after you had taken out the short position on BP, unrest in Libya has helped drive oil prices back up towards their pre-crash levels. In this situation, your investment would have lost a significant amount of its value, and you’d be left with a short position that was likely to incur further losses as oil prices continued their ascent.

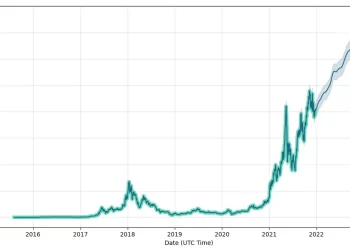

Of course, if an investor can correctly predict the market and has done it long enough to see that prediction play out, the profit potential can be overwhelmingly high. If you had chosen to take out a short position on BP in late June of 2010, it’s possible that you could have doubled your money by January 2011 when the price of Brent Crude started soaring after Libya suddenly cut its exports.

On the other hand, long positions are not guaranteed profits by any means either; for example, let us assume that instead of taking out short positions on BP at USD 50 per share in mid-June of 2010, you had instead decided to take out a long position at the same point in time. In this situation, oil prices continued to increase through the end of that year, and you’d have been sitting on a significant loss despite correctly predicting that a price rise was likely.

Risks of taking a long position

One major drawback to taking out a long position is that you have no guarantee of cash out at your original target price. If oil prices suddenly spike upwards due to some unforeseen event, any long positions taken out on oil futures contracts may quickly become losing ones as you watch the value of your investment skyrocket. This is especially dangerous when it comes to investing during periods of high inflation. With each month that passes, even investments that are likely profitable can suddenly turn into guaranteed losses if inflation continues to climb.

Risks of taking a short position

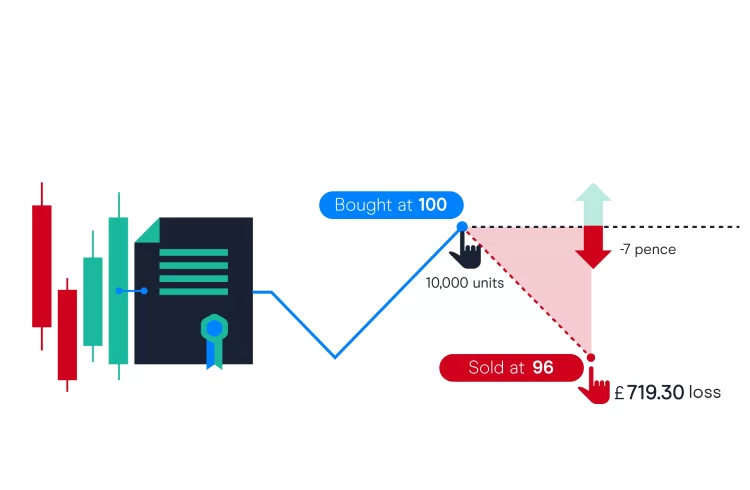

On the other hand, short positions in CFD trading carry two significant risks: firstly, they allow investors to lose money more quickly than long positions. If oil prices continue to plummet instead of to climb, short positions on oil futures contracts may require investors to pay out even more than their initial investment to bring them back up to break-even levels. This is especially dangerous when it comes to investing during periods of high inflation. As the value of your investment decreases with each month that passes, short positions may quickly grow so unprofitable that they become guaranteed losses compared to holding cash.

In situations where a small margin requirement can be enough to damage an investor’s account balance irreparably, it might be better to take out long positions instead–as even if oil prices should suddenly spike upwards, less money will be needed upfront for each trade.

Finally

When combined with additional research, this knowledge can help you take out positions that offer the highest possible rates of return for the amount of risk involved. New traders who want to trade CFDs should use a reputable online broker from Saxo Bank to help them get started on their demo account; get more info here.